Small businesses have always been the scrappy heroes of the American economy.

They create most of the jobs, fuel local communities, and somehow manage to innovate faster than companies with entire floors dedicated to “strategy.”

If you want to know where the economy is actually moving, skip the glossy Fortune 500 reports and look at the millions of firms with under 500 employees.

We’ve spent a huge amount of time unearthing the latest U.S. small business statistics for 2026.

For journalists, analysts, and anyone trying to make sense of the entrepreneurial heartbeat of America, consider this your data-rich, small business trend cheat sheet.

Let’s dive in!

TL;DR — Key Small Business Trends for 2026

If you want the 80/20 in one snapshot, here are the forces shaping U.S. small business performance in 2026:

- Small businesses generate 43.5% of U.S. GDP and employ 45.9% of the workforce.

- 70% of Americans trust small businesses more than any other institution.

- 91% of Americans shopped at a small business in the past week.

- About 80% of small firms struggle with late or slow customer payments.

- 58% of small businesses now use generative AI, up from 40% in 2024.

- Small firms drove 88.9% of all U.S. job growth between March 2023 and 2024.

- New businesses face $53,305 in regulatory compliance costs just to start.

- 63% of Americans would spend an extra $150/month to keep local stores running.

- Small firms created 62.7% of all net new jobs between 1995 and 2021.

- Women-owned employer firms grew to 1.309 million in 2022 (up from 1.134M).

Embed this infographic

Copy and paste this HTML onto your site

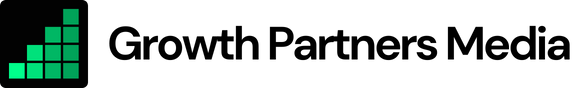

Small Giants: How They Power the U.S. Economy

Small businesses are the beating heart of the American economy.

Here’s what the data shows about the real backbone of U.S. commerce:

1. The U.S. is home to 34,752,434 small businesses, about 99.9% of all firms (source)

Basically, if you throw a dart at the map, you’ll hit a small business.

2. Small businesses generate 43.5% of U.S. GDP (source)

Nearly half the country’s economic output comes from companies run by people who still do their own invoicing.

3. They employ roughly 59 million people, about 45.9% of the American workforce (source)

Every second paycheck in the country comes from a small business. That level of impact sits at the core of the national economic system.

4. Small firms represent about 39% of all private-sector payroll (source)

The paychecks may vary in size, but the impact doesn’t.

5. Small businesses earn approximately 35–36% of total U.S. business receipts, about $13.3 trillion (source)

Not bad for companies that often start on folding tables and borrowed Wi-Fi.

6. Between 1995 and 2021, small businesses created 17.3 million net new jobs, 62.7% of all net new jobs (source)

When the economy needs fresh opportunities, small businesses don’t wait for permission. They hire.

7. Top industries by small-firm count include Professional & Business Services, Finance, and Retail/Wholesale Trade (source)

Professional services, finance, and trade are fields where reputation, speed, and tailored service matter. That is exactly where small businesses thrive, which is why these sectors attract some of the highest concentrations of small-firm activity.

8. Small businesses account for 32.6% of total U.S. export value (source)

International demand reflects more than industry strength. It reflects the reputation small businesses have earned for quality and consistency.

9. A record 5.5 million new business applications were filed in 2023 (source)

That’s the highest number in history, proving one thing: Americans bet on themselves, even in uncertain times.

The bottom line

Small businesses play a central role in how the U.S. economy actually functions. They generate a huge share of the country’s output, employ millions of people, and keep job creation moving forward year after year.

Their impact shows up not just in national statistics but in local communities, where they shape the rhythm of daily economic life.

U.S. Small Business Growth Trends

Despite inflation waves, credit crunches, and whatever the Federal Reserve feels like doing on a given Tuesday, the country’s small firms continue to open, hire, expand, and reinvent themselves at remarkable speed.

Here’s what the growth engine looks like based on the most recent data:

1. Between March 2023 and March 2024, small firms opened 1.10 million establishments and closed 982,940, a net gain of 116,060 (source)

Small business life isn’t calm, but the numbers show forward momentum. More opening bells than closing signs.

2. In that same period, small establishments added 14.4 million jobs and lost 13.0 million, for a net gain of 1.2 million jobs, representing 88.9% of all U.S. job growth (source)

The job market might be unpredictable, but small businesses continue to act like the country’s unofficial employment safety net. They hire aggressively, shed quickly when needed, and still end the year doing the heavy lifting on national job creation.

The corporate giants tend to grab headlines, but statistically, it’s the four-employee shop on Main Street that’s actually holding up the labor market.

3. August 2025 saw 473,679 new business applications, a 0.5% rise from July (source)

A month-over-month uptick during peak vacation season suggests something bigger: Americans aren’t waiting for “the right time” to start a business.

They’re building through economic noise, seasonal noise, and every other kind of noise because the opportunity is too tempting to pause.

4. Of those applications, an estimated 28,725 will become real operating businesses within four quarters, up 0.8% from the previous month (source)

Yes, most ideas stay ideas. But tens of thousands still make the leap.

5. From January to August 2025, the U.S. recorded 3,566,053 new business applications, up 3.15% year-over-year (source)

The pace of new business creation is clearly rising, and the momentum is unmistakable.

6. In 2024, the U.S. filed 5.21 million new business applications total (source)

We are still in the middle of the biggest business-formation wave in recorded U.S. history.

7. Retail e-commerce sales hit $304.2 billion in Q2 2025, up 5.3% from Q2 2024 and now 16.3% of all retail (source)

Online selling is no longer an optional channel. It’s the gravitational center of U.S. commerce.

8. 73% of U.S. small businesses now have a website (source)

The remaining 27 percent are operating without a reliable visibility channel in a market where customers research every decision.

9. 58% of small businesses use generative AI in 2025, up from 40% in 2024 (source)

Small firms are integrating AI to increase capacity, streamline processes, and handle more work without increasing headcount.

10. According to the 2024 Federal Reserve Small Business Credit Survey, 38% of employer firms saw revenue growth in the last year, while 41% saw declines (source)

Small business revenue is riding the economic roller coaster with no seatbelt. Growth is there, but so is turbulence, a reminder that small firms feel macroeconomic shifts faster and harder than anyone else.

11. California leads the nation with 4.34 million small businesses, followed by Texas (3.52M) and Florida (3.49M) (source)

Basically, America’s three biggest states are also its three biggest startup factories.

12. The highest share of small-business employment is in Montana (66.3%), Wyoming (65.2%), and Vermont (62.1%) (source)

In these regions, small business is the core engine that keeps entire communities running.

13. Women-owned employer firms grew to 1.309 million in 2022 (up from 1.134M in 2017) (source)

Women entrepreneurs are scaling at a pace that traditional markets can no longer ignore.

14. Minority women-owned employer firms surged to 385,119, up from 275,437 in 2017 (source)

This is one of the fastest-growing segments in the entire U.S. business landscape.

The bottom line

Even with shifting economic conditions, small firms continue to open, hire, and innovate at a pace that shapes the broader job market.

The steady rise in new business applications shows strong entrepreneurial confidence, and the consistent job gains highlight how essential small firms are to overall economic stability.

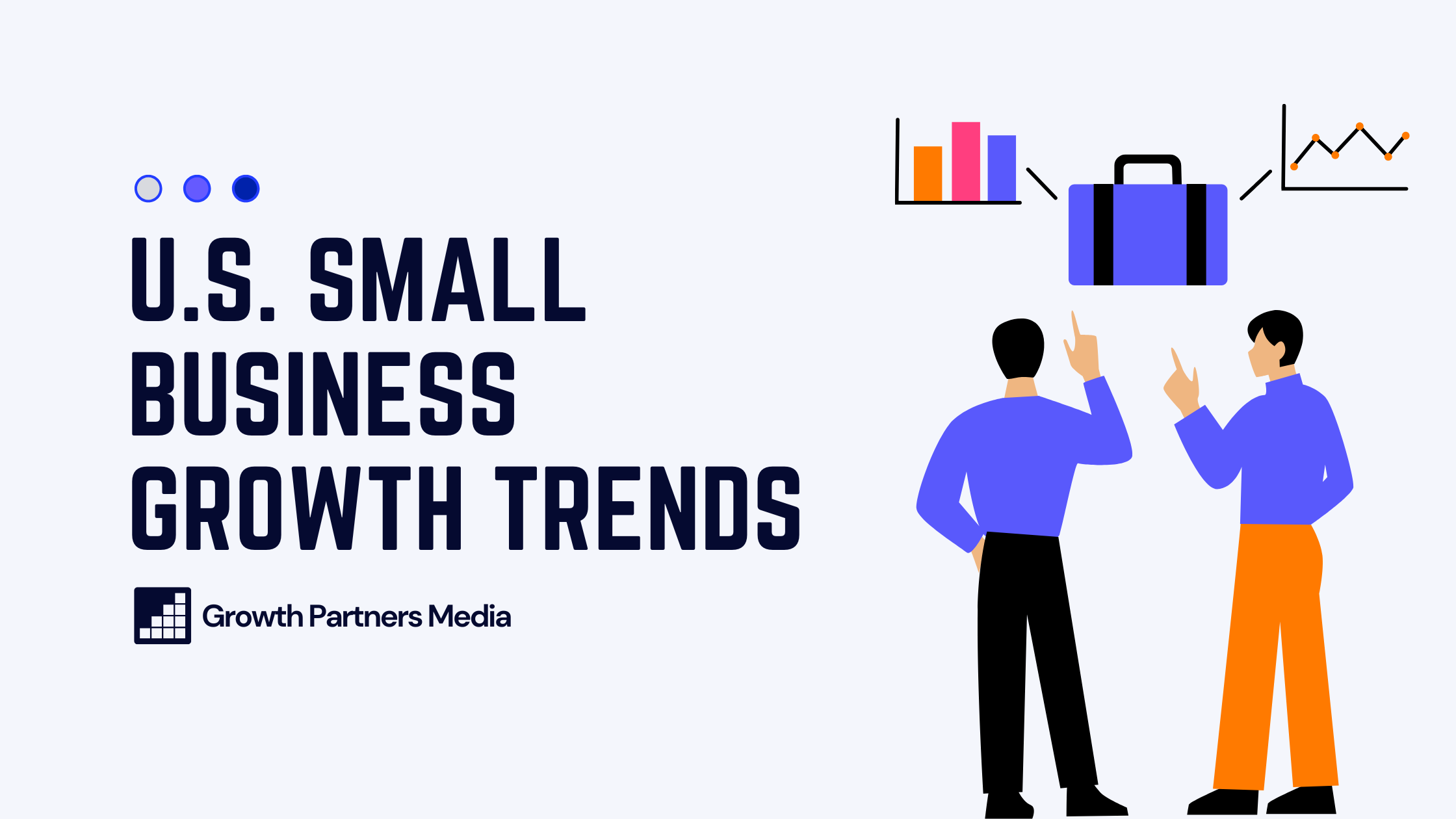

U.S. Consumer Behavior & Small Business Statistics

Americans shop small with a level of commitment that borders on tradition.

For many, it feels like community support, a weekend ritual, and the perfect justification for picking up yet another handcrafted candle.

The data paints a clear picture of a consumer base that values trust, local impact, and businesses that remember their name without checking a CRM.

Shopping frequency & consumer habits

1. 91% of Americans shopped at a small or local business in the past week (source)

Small businesses have become part of the weekly routine. Even during economic swings, customers keep coming back as if visiting the local shop is part of responsible citizenship.

2. The average American visits a local retailer 213 times per year, roughly every 1.7 days (source)

This is not ambient foot traffic. This is habitual engagement that staples small businesses to the center of neighborhood life.

3. 54% of U.S. adults shop at both small businesses and major retailers at least once a month (source)

Consumers use big-box stores for efficiency and small shops for the experiences algorithms still can’t replicate.

Trust, satisfaction & shifting loyalties

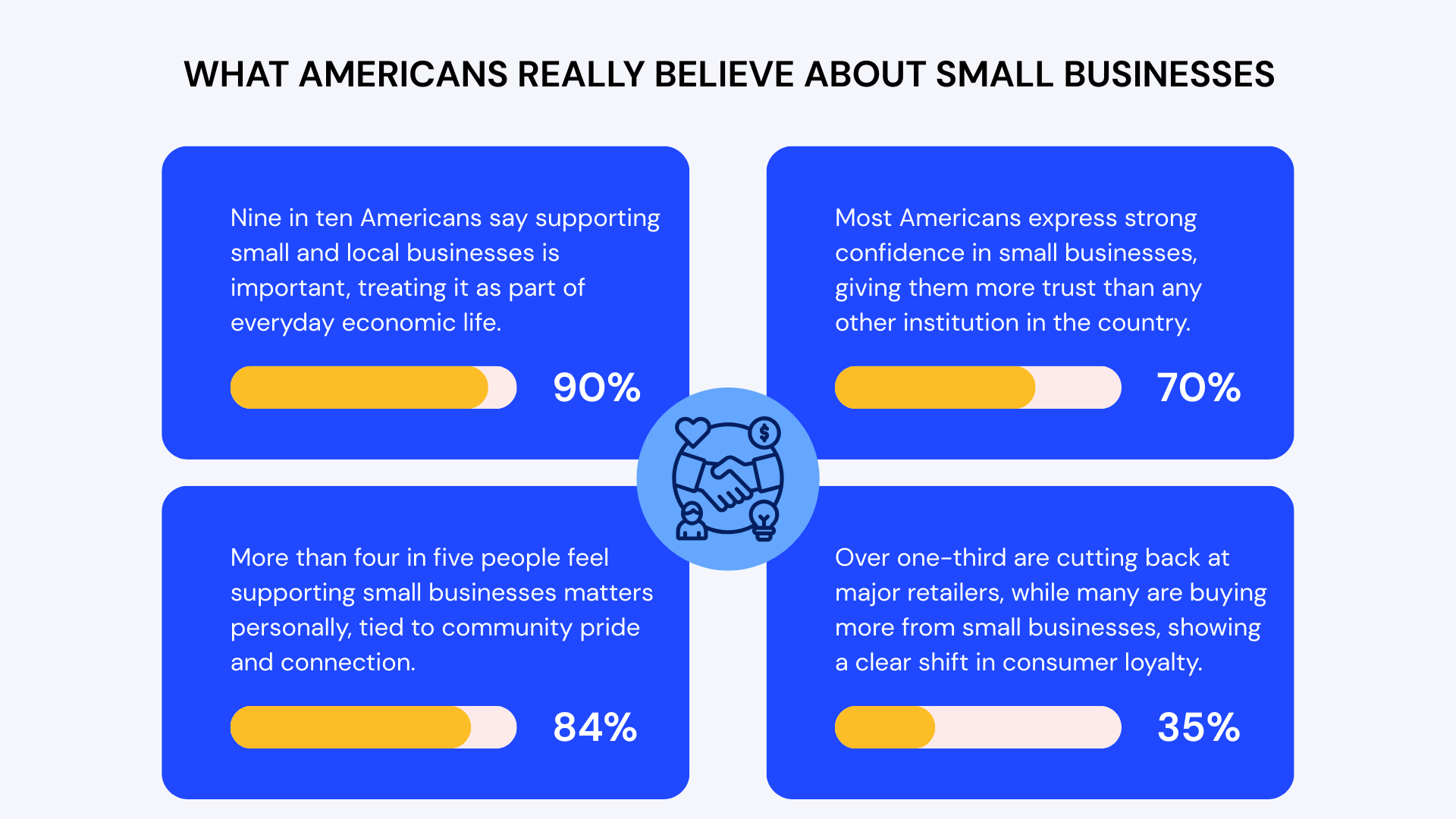

4. 70% of Americans express strong confidence in small businesses, the highest of any institution (source)

Trust has become a competitive moat. Small businesses earn it through accountability and consistency, traits that large institutions struggle to maintain.

5. 9 in 10 Americans say supporting small businesses is important (source)

This level of national alignment is rare. Consumers view small-business spending as both economic and ethical participation.

6. 84% say supporting small businesses matters personally (source)

Local retail taps into identity. People want their dollars to reinforce their communities rather than disappear into national supply chains.

7. 35% are spending less at major retailers this year, while 23% are spending more at small businesses (source)

Big retail is watching consumers shift their loyalty quietly but steadily. The momentum is moving to shops that feel human and present.

“Buy local” & community support trends

8. 75% say supporting the local economy is their main reason for shopping small (source)

Local commerce acts as a community engine. When consumers spend locally, they expect a visible return in neighborhood vitality.

9. 74% prefer browsing or buying from local or independent retailers rather than online (source)

Small retailers win by creating environments that reward attention. People want the tactile reassurance that digital shopping often can’t deliver.

10. 63% would spend an extra $150 per month to keep local stores running (source)

Customers display a willingness to subsidize the survival of businesses they believe matter. That level of financial goodwill is rare in modern commerce.

11. 71% believe the federal government should expand support for small and local businesses (source)

Policy pressure is rising. Support for small businesses has become a mainstream economic expectation, not a niche advocacy goal.

Digital & mobile shopping behavior

12. 90% read online reviews before purchasing (source)

Online reputation has become the new storefront. A single review page carries more influence than a full marketing campaign.

13. 50% of online searches for local goods lead to an in-store visit within 24 hours (source)

Search behavior now funnels customers directly toward local businesses. Digital discovery is no longer optional for brick-and-mortar success.

14. 37% research online and then purchase in-store (source)

Hybrid shopping patterns are the norm. Consumers want intel first and interaction second.

15. 65% use a smartphone to browse, compare, or buy gifts (source)

Mobile optimization determines who wins holiday sales. Slow-loading sites are losing revenue without realizing it.

16. 47% of small businesses expect to sell through both online and in-store channels (source)

Omnichannel commerce has matured into a baseline strategy. Retailers who don’t adapt are placing their entire customer flow at risk.

17. 52% of shoppers plan to split purchases between online and physical stores (source)

Flexibility defines modern purchasing behavior. Retailers must structure their experience around wherever the customer decides to land.

Loyalty drivers & why customers return

18. 69% say competitive pricing is a top driver of return visits (source)

Price sensitivity still drives decision-making. Customers appreciate charm, but affordability keeps them coming back.

19. Nearly 90% of independent retailers emphasize personalized service and curated selections (source)

Personalization remains the advantage big retailers can’t engineer. Human memory still outperforms automated recommendations.

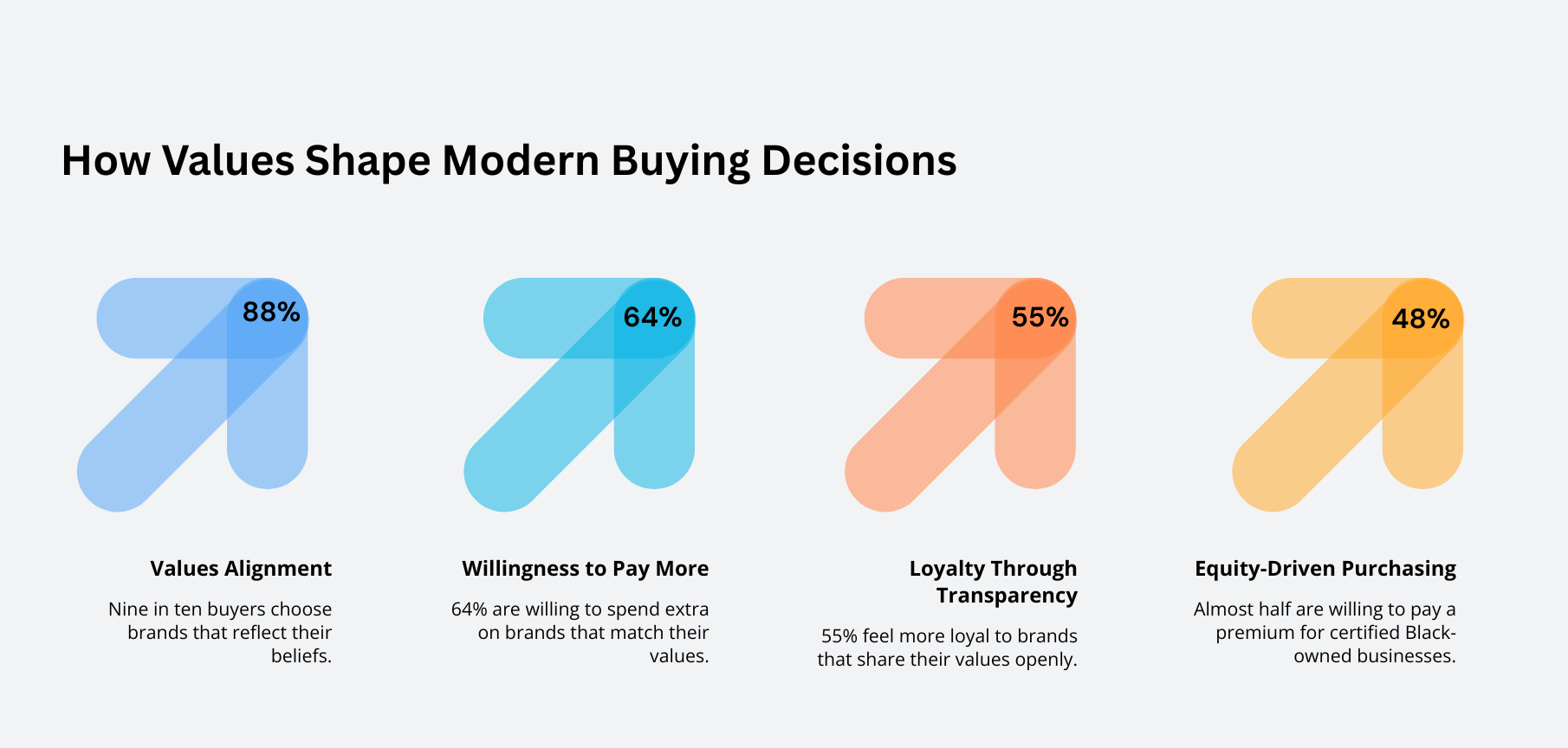

Values-driven purchasing

20. 88% buy from brands aligned with their values (source)

Ethical alignment has become a filter, not a bonus feature.

21. 64% are willing to pay more for products from companies that match their beliefs (source)

Brands gain pricing power when customers see integrity in action.

22. 55% feel more loyal to brands that share their values publicly (source)

Transparency builds trust and reduces churn.

23. 48% would pay a premium for certified Black-owned businesses (source)

Consumers are directing spending toward representation and equity with intention, not impulse.

24. Studies show buyers are more forgiving of product issues when businesses are labeled “Black-owned” or “woman-owned” (source)

Consumers assign more empathy to businesses with a clear identity and mission, strengthening long-term loyalty.

The bottom line

Americans continue to show strong loyalty to small businesses, and that loyalty shows up in how often they shop locally and how much they value trust, connection, and community.

People want meaningful experiences, not just transactions, and small businesses deliver that in ways larger retailers rarely match.

Online discovery also drives shoppers straight to local stores, which gives small businesses even more opportunities to stand out.

Small Business Financial Health & Cash Realities

Money keeps small businesses alive, but it also keeps them up at night. The financial picture for 2026 shows a sector full of ambition, grit, and spreadsheets in various stages of panic.

These stats reveal how small firms are earning, spending, and surviving in an economy that loves testing their patience.

1. 41% of small business owners reported at least $1 million in annual revenue, while 18% earned under $100,000 (source)

The small-business landscape is a tale of two economies. A healthy chunk is breaking into seven figures, proving small doesn’t mean small-time.

But nearly one in five are still operating closer to passion-project margins than polished-enterprise numbers.

2. Only about 46% of small employer firms were profitable in 2023 (source)

Less than half of small firms are actually making money. The rest are breaking even or losing ground, which puts the “backbone of the economy” under more strain than the slogan suggests.

It’s not a lack of effort. It’s rising costs, uneven demand, and the perpetual squeezing of already thin margins.

3. 45% of small business owners skipped paying themselves because of cash-flow shortages; 22% struggled to cover basic bills (source)

Nearly half of owners are running the show without paying themselves first, which is the entrepreneurial version of running a marathon without water.

4. Roughly 80% of small firms report problems with late or slow customer payments (source)

Late payments have become an involuntary financing model. Customers treat due dates like polite suggestions, and small businesses end up absorbing the shock. The result: financial whiplash that disrupts planning, hiring, and growth.

5. About 70% of small businesses have less than four months of cash reserves (source)

Thin reserves don’t always mean poor management. They can also reflect how tight operating margins have become in a high-cost, high-volatility environment.

6. 75% of small firms cite rising operating costs as a top financial challenge (source)

Inflation may be cooling on paper, but small businesses are still getting punched in the face by higher prices for inputs, software, insurance, and labor.

Every dollar is doing the job of two, and owners are constantly recalculating just to keep the doors open.

7. Only about 51% of small-business loan applications were approved (down from ~55% pre-pandemic) (source)

Approval rates are stuck near decade lows, which means growth plans stall, expansions stay dreams, and many small firms are forced to self-fund in an economy where self-funding is risky at best.

8. In 2024, only 41% of businesses received the full amount of financing they requested; 24% received none (source)

Even when owners muster the courage to apply, the system often sends them home empty-handed. Partial financing doesn’t solve capital problems. It simply delays them.

9. The average interest rate on short-term small-business loans was about 9.7% in late 2024 (source)

High rates turn everyday financing into a strategic gamble, where the cost of capital eats into the very gains it’s meant to accelerate.

The bottom line

Many small businesses are working through financial strain, from uneven cash flow to rising expenses and limited funding options.

Owners keep adjusting, problem-solving, and finding ways to move forward, which shows how much determination goes into keeping these businesses alive.

Understanding these pressures gives a clearer picture of what daily life looks like for small business owners and why stronger financial support can make a real difference.

The Friction Points: U.S. Small Business Challenges

Small businesses may power the U.S. economy, but they do it while juggling regulations, talent shortages, rising costs, cybersecurity headaches, and supply chain plot twists that feel straight out of a stress-inducing Netflix series.

These stats show the real obstacles entrepreneurs are wrestling with this year:

Regulatory burdens

1. $53,305 – that’s the average regulatory compliance cost to start a business (source)

For many founders, the cost of turning an idea into a legal entity rivals the price of a luxury car. Compliance has become the unofficial “entry fee” for entrepreneurship.

2. 44% say licensing and permit rules make growth harder (source)

Red tape slows expansion faster than market competition. Many firms spend more time navigating forms than finding customers.

3. 42% say they spend too much time on compliance tasks (source)

Small-business owners wear many hats, but “part-time government clerk” was never supposed to be one of them.

4. 67% believe small firms spend more per employee on compliance than big companies (source)

Big companies spread compliance costs across armies of employees. Small firms, on the other hand, pay the same bill with a team that can fit in a minivan.

Labor market challenges

5. 32% report job openings they can’t fill (source)

Small businesses are fishing in a labor market where demand outpaces supply, and candidates hold more leverage than ever.

6. 49% say qualified applicants are scarce (source)

Small firms are competing not just with each other but with remote-first employers, rising wage expectations, and a workforce that’s far more selective about where and how it works.

7. 27% cite “labor quality” as their top problem (source)

Skill mismatches remain a glaring productivity drag, especially for technical roles.

8. 26% raised compensation in October 2025 (source)

Wages keep climbing because it’s cheaper to pay more than to hire the wrong person twice.

Mental health & burnout

9. 52% of small business owners felt stressed this past year; 35% felt mentally exhausted (source)

Entrepreneurs often look like they’re “handling it.” The data says many are one unexpected invoice away from burnout.

Cybersecurity

10. 47% updated their cybersecurity solutions this year (source)

Modernization is happening, but usually after a scare.

11. 52% believe growth increases cyberattack risk (source)

More customers attract more revenue and more hackers.

Supply chain & logistics bottlenecks

12. 60% say supply chain disruptions affected their business in late 2025 (source)

The supply chain never fully healed. It just reorganized its chaos.

13. 19% (especially younger owners) cite supply chain issues as a major growth obstacle (source)

Younger entrepreneurs are pushing for agility, but that’s hard when your inventory is stuck in a warehouse three states away.

Uncertainty & business confidence

14. Small Business Confidence Index: 72.0 (record high) (source)

Confidence is high, possibly because optimism is cheaper than capital.

15. Net 20% of owners expect better conditions in the next six months (lowest since April 2025) (source)

Confidence may be up, but expectations are cautious. Owners believe in themselves; they’re less sure about the economy.

The bottom line

Small businesses are managing a complex set of challenges that can quickly pile up, from regulations and hiring shortages to supply chain issues and rising expenses.

These pressures shape the day-to-day reality of running a business and leave owners constantly adjusting to keep things moving.

The Small Business Engine Still Runs the Country

When you step back from the spreadsheets, a pattern comes into sharp focus. Small businesses are adjusting, reinventing, recalibrating, and finding momentum in corners of the economy most forecasts barely bother to chart.

The survival rates, revenue shifts, hiring pressures, consumer loyalty swings, tech leaps, and regulatory hurdles all tell the same story:

Running a small business in 2026 is not simple, but it is absolutely consequential.

These firms are absorbing shocks, spotting opportunities early, and navigating volatility with a blend of grit and creativity you can’t manufacture in corporate training modules.

If there’s a takeaway worth underlining, it’s this:

The health of small businesses is far beyond a footnote to the U.S. economy. It’s actually the indicator. The leading signal.

Watch these firms closely, because they show where the real economy is going long before the headlines catch up.

- 70+ Important U.S Small Business Statistics [2026] - January 13, 2026

- 80+ Revealing Remote Work Statistics & Trends [2026] - January 13, 2026

- 30+ Video Marketing Statistics You Should Know [2026] - December 9, 2025